EXPERTISE

INSPECTION

Bill 16: What You Need to Know in

Bill 16 was passed on December 5, 2019. Several provisions related to divided co-ownership (condominiums) have been in force since January 10, 2020.

The implementation regulation, which outlines the requirements for the maintenance logbook, reserve fund study, and co-ownership certificate, was published on July 30, 2025 (Decree 991-2025) and took effect on August 14, 2025.

This guide explains each obligation and the key dates for compliance.

| Obligation | Description | Effective date | Compliance deadline |

|---|---|---|---|

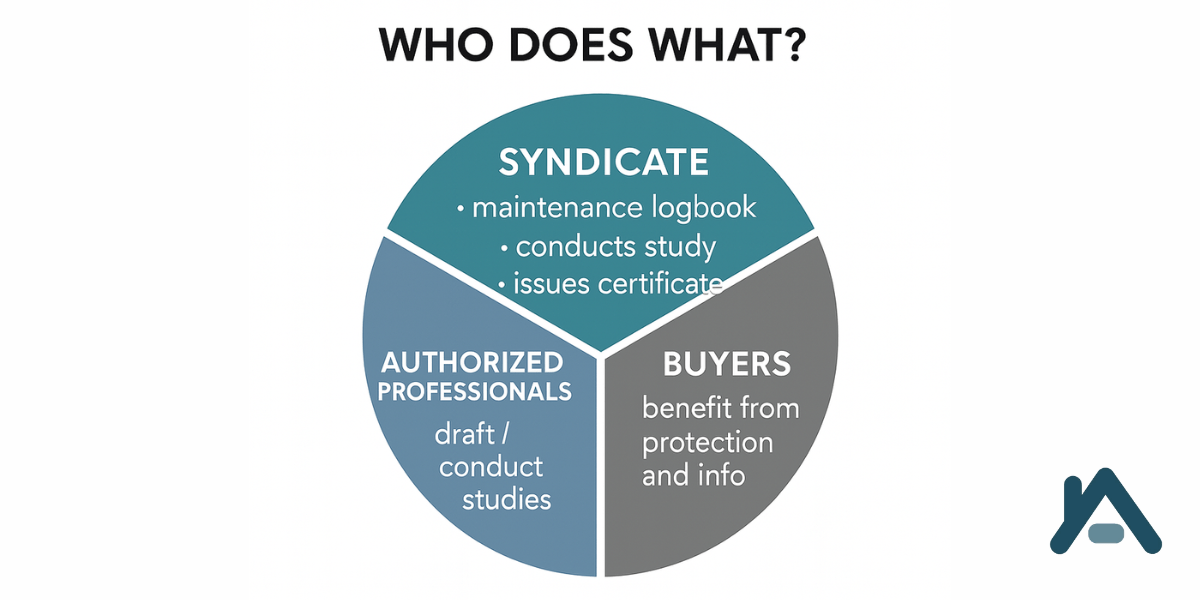

| Maintenance logbook | Prepared by an authorized professional such as an engineer (OIQ), architect (OAQ), professional technologist (OTPQ), or chartered appraiser (OEAQ) who is independent of the syndicate. Must be updated annually, with a full review every 5 years, or every 10 years for a small building that meets the criteria (8 units or fewer, or 3 above-ground floors or fewer, or no interior common areas). Must include a 25-year plan for major repairs. |

Aug. 14 2025 | Aug. 14 2028 |

| Reserve fund study | Conducted by an authorized professional (OIQ, OEAQ, OAQ, OTPQ, or CPA) who is independent of the syndicate. A new study is required every 5 years and must include cost estimates for future work and adjusted contributions. | Aug. 14 2025 | Aug. 14 2028 |

| Co-ownership certificate | Required for any sale. Includes financial statements, repairs, disputes, insurance, reserve fund and self-insurance balances, and the recommended amount from the latest reserve fund study. | Aug. 14 2025 | Immediate |

| Buyer deposits | Must be placed in trust with a notary, lawyer, CPA, or other authorized professional. | Aug. 14 2025 | Immediate |

Get a free quote to comply with Bill 16

Maintenance logbook

Since August 14, 2025, all divided co-ownerships in Quebec must have a maintenance logbook that meets the requirements of Bill 16.

This document must be prepared by an authorized professional (OIQ, OEAQ, OAQ, OTPQ) who is independent of the syndicate. It must:

- List all components of the building and their condition

- Include a plan for major repairs and replacement of common elements covering a period of at least 25 years

- Specify the timelines and estimated costs for each intervention

Mandatory updates:

- Every year: the logbook must be updated to include all work done on the building

- Every 5 years: a complete review must be conducted by a professional

- Every 10 years if the building qualifies as a small property (8 units or fewer, or 3 above-ground floors or fewer, or no interior common elements)

Compliance deadline: Syndicates have until August 14, 2028 to have a compliant logbook in place.

Reserve fund study

Since the law came into force, the reserve fund must be managed under stricter rules to ensure the long-term upkeep of the building.

Every 5 years, the syndicate must have a reserve fund study prepared by a qualified professional from the approved professional orders (OIQ, OEAQ, OAQ, OTPQ, CPA). The study must:

- Assess the condition of the common elements and estimate their remaining useful life

- Provide cost estimates for repairs or replacements over a minimum period of 25 years

- Determine the level of contributions needed to cover this work without deficit, based on actual needs rather than a fixed percentage of common expenses

All divided co-ownerships must have a compliant study completed by August 14, 2028.

Co-ownership certificate

Since August 14, 2025, the sale of any divided co-ownership unit in Quebec must include a certificate issued by the syndicate of co-owners.

This document must include:

- Financial status (budget, reserve fund balance, self-insurance fund balance)

- List of major repairs planned or in progress

- Ongoing legal disputes

- Current insurance coverage

Recommendations from the most recent reserve fund study on the amount that should be available at the start of the year.

Mandatory deadline: The certificate must be provided within 15 days of the request by the selling co-owner.

Buyer deposits

Also in effect since August 14, 2025, Bill 16 requires stronger protection for deposits paid by buyers when entering into a purchase agreement for a divided co-ownership unit.

All deposits must be placed in trust with an authorized professional, such as:

- A notary

- A lawyer

- A Chartered Professional Accountant (CPA)

This applies to both new builds and resales. It ensures that buyer funds are not used for other purposes and remain protected in the event of a dispute or bankruptcy.

Application: This obligation has been in effect immediately since August 14, 2025.

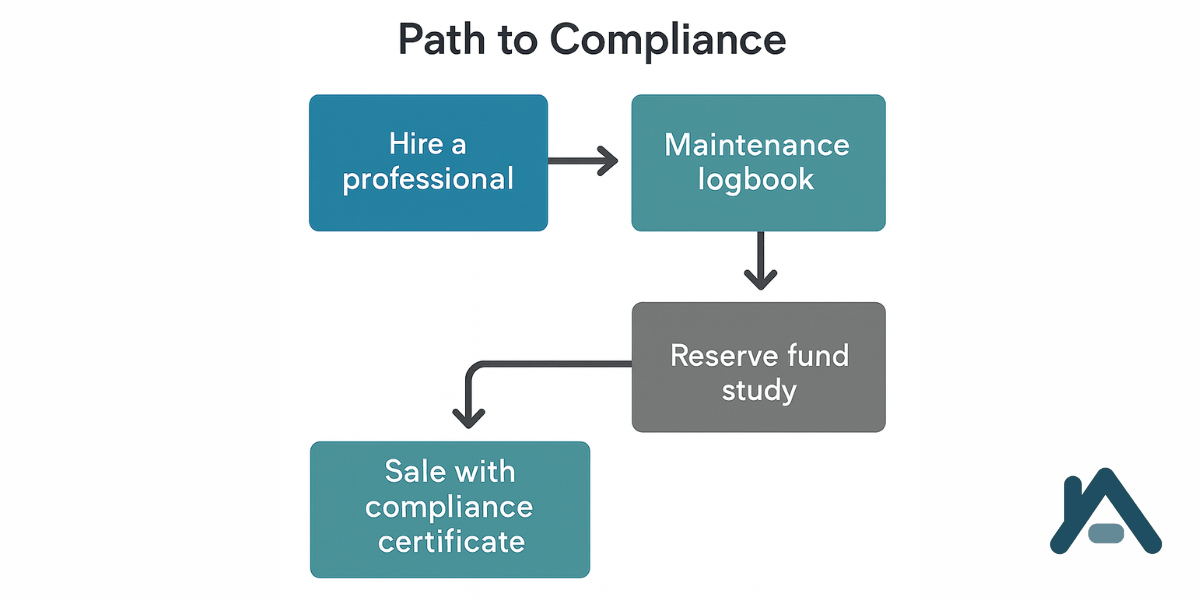

How Genispec can help you comply with Bill 16 in

Our team of building engineers in Montreal can assist you with:

- Maintenance logbook

- Reserve fund study

- Co-ownership certificate on the condition of the syndicate

We serve the Greater Montreal area as well as the Rive Nord and Rive Sud. Need more information? Contact Genispec to request your free quote.

What is Bill 16?

Bill 16 was introduced to address the growing challenges faced by condominium syndicates as this form of housing becomes more common in Quebec. The government established new rules to strengthen condominium management.

The main goal is to modernize the legal framework to better meet the evolving needs of the real estate sector, particularly in management practices, and to ensure that processes are more effective and aligned with today’s realities.

Key Dates to Remember

| Date | Event |

|---|---|

| Dec. 19 2019 | Adoption of Bill 16 by the National Assembly of Quebec |

| Jan. 10 2020 | First provisions take effect (partial) |

| July 30 2025 | Publication of the implementation regulation |

| Aug. 14 2025 | New obligations come into force (logbook, reserve fund, certificate, etc.) |

| Aug. 14 2028 | Deadline to comply with obligations (logbook and reserve fund study) |

Other important points in Bill 16

Along with the new obligations taking effect between 2025 and 2028, Bill 16 also contains provisions that have been in force since January 10, 2020. These measures aim to improve transparency, protect buyers, and ensure proper condominium management in Quebec.

Penalty clause

The penalty clause in a declaration of co-ownership allows the syndicate to sanction owners who do not follow the established rules, for example, failing to pay condo fees or carrying out unauthorized work.

Before the reform, such a clause could often be added or changed by a simple majority vote at a meeting. Since Bill 16, any modification or addition to a penalty clause requires amending the constitutive act of co-ownership, which involves a higher voting threshold, a notarized act, and registration in the land register.

Buyer protection

Bill 16 guarantees that prospective buyers have access to key information about the condominium before purchase, whether for a new or existing unit.

The developer must set up a reserve fund at delivery and provide detailed information about materials, management, and layout.

These measures are supported by stricter rules for condominium syndicates, including the obligation to have a maintenance logbook, a reserve fund study, and a self-insurance fund.

Transparency in sales

The seller must provide the buyer with the co-ownership certificate that details finances, planned work, and the building’s condition.

These requirements have been in place since 2020, but the 2025 regulation clarifies the mandatory content and the 15-day delivery deadline.

Insurance and financial security

Reinforced insurance requirements play an important role in providing future buyers with reliable information about their investment, while protecting the building’s value and long-term stability.

What Bill 16 means depending on your situation

| Profile | Main obligations | Effective date | Compliance deadline |

|---|---|---|---|

| Existing condominium | Compliant maintenance logbook prepared by an authorized professional (OIQ, OEAQ, OAQ, OTPQ, independent) Review of the reserve fund study every 5 years Annual logbook updates and full review every 5 or 10 years, depending on criteria |

Aug. 14 2025 | Until Aug. 14 2028 |

| Newly built condominium (developer) | Delivery of a compliant maintenance logbook (OIQ, OEAQ, OAQ, OTPQ, independent) and first reserve fund study (OIQ, OEAQ, OAQ, OTPQ, or CPA, independent) Presentation of the initial budget and work projections at the transition meeting |

Jan. 10 2020, clarified by regulation on Aug. 14 2025 | Within 30 days after the transition meeting |

| Sale of a unit (all types) | Provide co-ownership certificate that includes financial statements, fund balances, planned work, disputes, insurance, and recommendations from the reserve fund study Delivery required within 15 days after request from the seller |

Jan. 10 2020, clarified by regulation on Aug. 14 2025 | Immediate |

Benefits of Bill 16

| Problem before Bill 16 | Solution under Bill 16 | Concrete benefit |

|---|---|---|

| Missing or incomplete maintenance logbooks | Obligation to have a compliant logbook prepared by an authorized professional, with annual updates and periodic reviews | Clear understanding of building condition and 25-year planning |

| Reserve funds insufficient due to arbitrary contributions | Mandatory study every 5 years by an authorized professional to set contributions based on actual needs | Fair contributions that avoid deficits or special assessments |

| Buyers lacking accurate information about the condominium | Mandatory co-ownership certificate (finances, work, disputes, insurance) within 15 days | Informed purchase decisions and fewer post-sale disputes |

| Buyer deposits unprotected or mismanaged | Mandatory deposit in trust with a notary, lawyer, or CPA | Financial security for buyers in case of dispute or bankruptcy |

| Lack of transparency from developers | Mandatory delivery of logbook and first reserve fund study at the transition meeting | Stronger starting point for condominium management and stable finances from the beginning |

Latest updates on Bill 16

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.